Privy is India’s Leading DPDP Compliance Solution

Partnering with brands like

A DPDP Solution for Comprehensive Consent & Privacy Governance for Data Fiduciaries and Data Processors

Nascent & Nuanced Regulation

Data privacy regulations are dynamic in nature. The Privy team works closely with MEITY representatives, leading privacy practices at law firms and Big 4 consulting firms to stay compliant while rolling out complex, enterprise implementations.

People-Process-Technology

The team brings a holistic consultative approach to DPDP compliance. Legacy systems did not account for a privacy-focused architecture so the DPDP transformation demands a re-look at role-skills, training and controls as much as the tech.

A DPDP solution by DPOs, for DPOs

Our team comprises of certified privacy professionals and experienced Data Protection Officers who understand what it takes to successfully launch and maintain privacy-compliance and data-protection in large enterprises

Transparency with Data Principals

At Privy & IDfy, we believe that user trust is paramount. Users are tired of misuse of their data. By building a transparent onboarding journey and data protection controls – you will benefit from a boost in your customer trust and respect.

Privy’s modules help you comply with the DPDP Act and avoid fines!

Consent Governance

Language Translation

Data Protection Impact Assessment

Breach Reporting Module

Data Principal Access Request

Data Processor Management

Parental Consent Management

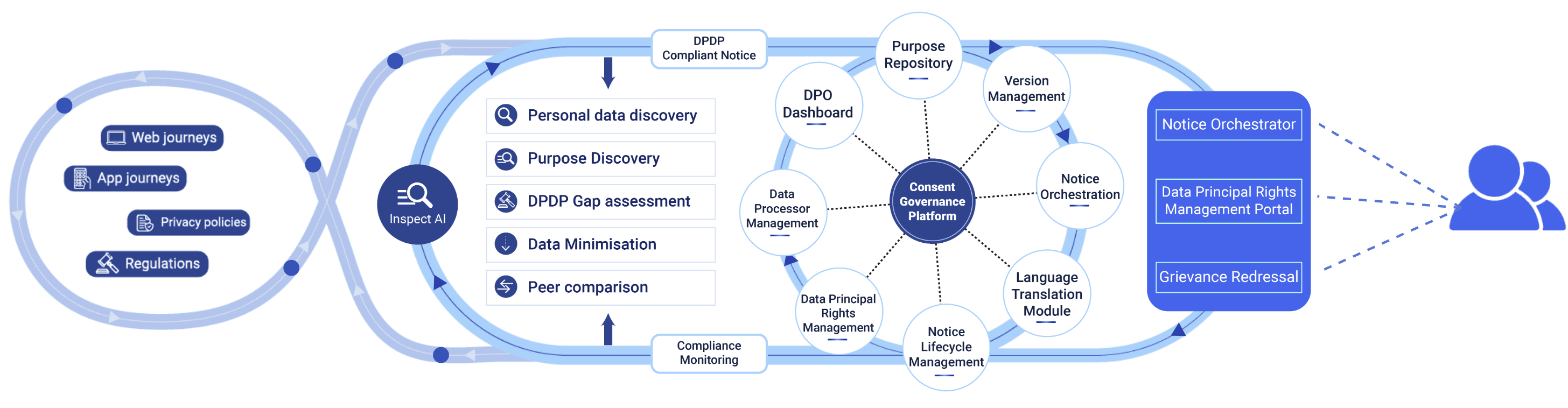

Achieve end-to-end DPDPA compliance with Privy

Working only with the best, to ensure the quality of our services, and to bring state of the art technology to those who need it.

Who is Privy for?

Data Protection Officers

Privy empowers your Data Protection Officers (DPOs) by giving them a suite of advanced tools to manage your privacy programs and strategic data protection projects.

- With solutions like Inspect AI, DPOs can automate the compliance assessment process, identify gaps in privacy at real time across the digital journey, reduce workload, and minimize error.

- The CGP streamlines the management of consent lifecycle activities from collection to revocation, in full compliance with the changing regulation of jurisdictions such as India’s DPDPA.

- Third Party Compliance Management is one of the tools DPOs can use to ensure processors and other business partners meet high levels of privacy.

- Privy also helps with Breach Reporting and Data Principal Rights Management, which helps in on-the-spot incident responses, audits, and data subject requests.

This way, the DPO can maintain transparency and trust among data subjects by giving real-time updates through the central dashboard, custom notices, and automation features, thus allowing for more agile and accurate execution of data protection strategies with confidence.

Tech teams

Privy offers technology teams a platform, which can easily integrate into an organization’s existing technology stack, thereby not letting the performance or operational efficiency take a hit.

- The architecture of the platform sets up an easy-to-integrate set of enterprise systems that allow for seamless collaboration with consent management tools, data processors, and other privacy-enhancing technologies.

- Privy’s solutions, like Inspect AI and the Consent Governance Platform (CGP), can easily embed in a broad range of digital workflows, applications, and customer touchpoints.

- These functions ensure that real-time compliance with privacy – such as collection and management of Records of Processing Activities, as well as third-party checks – occur without adding latency or disrupting user experience.

Thus, Privy is a safe, scalable solution for regulatory compliance for technology teams.

Risk and compliance teams

Privy helps compliance managers and risk teams with a detailed framework on the implementation of effective measures under the Digital Personal Data Protection (DPDP) Act.

- Compliance managers can easily manage and audit consent processes with tools like Consent Governance Platform (CGP) which ensures DPDP compliance of all data processing activities.

- Privy simplifies the management of Records of Processing Activities (RoPA) and provides such features as Third-Party Compliance Management, enabling supervision over outside data processors and mitigation of risks connected with them.

- The platform also includes modules for reporting data breaches so that these data breaches are reported in good time and with precision both to the data principals and the Data Protection Board hence mitigating legal and reputational risks.

The compliance managers can, on detailed compliance dashboards and audit trails, depict their organization’s adhered with the implementations of the privacy regulations through openly verifiable means, assisting audits as well as much more easily and at ease with regulatory inspections.

Understand the DPDP Act better before integrating a DPDP solution

Processing the DPDP Act: What Data Processors must know

Data Processors are often overlooked in discussions about compliance, largely because fines are typically imposed on Data Fiduciaries (DFs).

Watch our webinar with industry experts from Khaitan & Co. and Haptik

DPDP jargon simplified

Meet Consent Chaudhary, Privy’s DPDP expert who will explain the complexities of the DPDP Act in a fun comic book!

Top 10 banks in India are not compliant

We at IDfy analyzed 251 digital journeys of the top 10 banks in India, across 4 use cases and here’s what we found….

Download the report to discover the ugly truth!

Privy-A DPDP Solution for your compliance needs

Book a free consultation with our experts now and discover how our services can help your organization achieve DPDP compliance.

At Privy, we understand the intricacies of maintaining users’ consent as well as ensuring compliance with privacy laws such as the Digital Personal Data Protection Act (DPDPA).

Your benefits:

- Expert Guidance on Data Privacy

- Automate Compliance

- Real-Time Monitoring

- Scalable Solutions

Schedule a Free Consultation

FAQ on the DPDP Act, DPDP Solution, DPDP rules and more…

What is the Digital Personal Data Protection (DPDP) Act of India?

The DPDP Act is India’s comprehensive data protection legislation that regulates the processing of personal data by organizations to safeguard individuals’ privacy rights. It outlines principles for collecting, using, and storing personal data and defines responsibilities for data fiduciaries (organizations that determine how data is processed) and data processors (entities that process data on behalf of fiduciaries). The DPDP Act also ensures individuals, known as data principals, have specific rights over their personal data, including the right to access, correct, and erase their data.

What are the key principles of the DPDP Act?

The DPDP Act is based on several core principles:

- Lawfulness and Fairness: Personal data must be processed lawfully and fairly.

- Purpose Limitation: Data must only be collected for specified, clear, and lawful purposes.

- Data Minimization: Only the minimum amount of data necessary for the intended purpose should be collected.

- Accuracy: Personal data must be accurate and updated when necessary.

- Security: Organizations must implement security measures to protect data.

- Data Subject Rights: Individuals have rights such as the right to access, correct, and delete their personal data.

What should a DPDP solution have?

A good DPDP solution should have the following must-haves to help companies achieve DPDP compliance:

- Consent lifecycle management: Data principals should be able to revoke consent as easily as they give it. This is only possible if a DPDP solution has the capability to streamline data collection across multiple touchpoints in a customer journey, present consent notices in multiple languages and more. Data fiduciaries should be able to keep data principals updated on their requests to access, delete or modify their personal data with ease.

- Managing data processors: Data fiduciaries should be able to use a DPDP solution that will help them maintain a database of the data processors they are working with. They should also be able to assign the processing of certain data journeys to the suitable processors and track their activities.

- Maintaining Records of Processing Activities (RoPA): The provision of maintaining the entire history of data processing with the purpose should be available.

- Take sector-specific regulations into consideration: A DPDP solution should have the necessary tools to help companies comply with their industry-specific regulations. For example, banks, NBFCs, insurance companies are governed by a number of regulations such as the RBI, IRDAI, SEBI, etc. So the provisions to easily comply with these regulations should be made available in an ideal solution.

- Security: A DPDP compliance solution should be secure enough to handle the personal data of data principals. Audit trails need to be maintained and no unauthorized manipulation of consent artifacts should occur.

What are some of the security components that a DPDP solution must have?

A DPDP solution should be embedded with strong security and encryption features such as SHA-256 encryption, AES-256 for data at rest and TLS (Transport Layer Security) for data in transit. These help with preventing unauthorized access to sensitive data. It is also good to have ISO and SOC 2 certifications to help build security credibility.

What should companies consider before implementing a DPDP solution?

Companies should ensure that a DPDP solution is equipped to handle industry-specific regulations (depends on the industry they are into). A DPDP solution should also be one that is easy to integrate and can fulfill everything from managing consent lifecycles to generating consent notices and more.

When will the DPDP rules be out?

The DPDP rules will come out soon and a lot of provisions in it will be a detailed extension of the DPDP Act 2023.

Should a company integrate a DPDP solution immediately?

According to MeitY, companies should not wait for the rules and establish their roadmap for DPDP compliance at the earliest. This includes looking for an ideal DPDP solution that can help them to comply with the DPDP Act.

Who is a data principal under the DPDP Act?

A data principal is the individual whose personal data is being collected or processed. Under the DPDP Act, data principals have various rights, such as the right to access their personal data, correct inaccuracies, withdraw consent, and request erasure. These rights empower individuals to have greater control over how their personal information is handled.

Who is a data fiduciary?

A data fiduciary is any entity, organization, or individual that determines the purpose and means of processing personal data. This includes businesses, institutions, and public authorities. Data Fiduciaries are responsible for ensuring that personal data is collected, stored, and processed in compliance with the DPDP Act, and they are held accountable for any breaches or violations.

What rights do data principals have under the DPDP Act?

- Data principals (individuals) have several rights under the DPDP Act, including:

- Right to Access: The right to know what personal data is being collected and processed.

- Right to Correction: The right to request corrections to any inaccuracies in their data.

- Right to Erasure: The right to request deletion of their data when it is no longer needed or if it was processed unlawfully.

- Right to Data Portability: The right to receive their data in a commonly used format to transfer it to another service.

- Right to Withdraw Consent: The ability to withdraw consent for data processing at any time.

What are the penalties for non-compliance under the DPDP Act?

Penalties for non-compliance under the DPDP Act can be severe. Organizations that violate the provisions may face fines based on the severity of the breach. For instance, fines for failing to protect personal data adequately or for not responding to a Data Principal’s rights request can reach up to INR 250 crore. These penalties are intended to ensure that organizations take data protection seriously and implement robust compliance measures.

What is a consent artifact?

A consent artifact is a digital record that captures the details of consent given by a Data Principal (individual) for the processing of their personal data. It includes information such as the purpose of data processing, the data fiduciary’s identity, and the conditions under which the data will be processed. The consent artifact is immutable and serves as proof that valid consent was obtained from the individual.

How are consent artifacts stored and managed?

Consent artifacts are stored in a secure, tamper-proof manner, often using hashing technologies like SHA-256 to ensure data integrity. These artifacts are managed through systems such as Privy’s Consent Shield, which implements versioning and encryption to protect the consent record. Each artifact is associated with a timestamp and details of the processing purposes, ensuring a clear audit trail for compliance purposes.

Why are consent artifacts important?

Consent artifacts are critical for demonstrating compliance with data protection regulations like the DPDP Act. They provide verifiable proof that valid, informed consent was obtained from individuals before their personal data was processed. This helps protect organizations in the event of disputes or audits, as they can show regulators that all data collection and processing activities were conducted legally.

Can a consent artifact be updated?

Yes, consent artifact can be updated when a Data Principal modifies their consent, such as by revoking or granting additional permissions. Each update is recorded as a new version of the artifact, ensuring that the history of consents is preserved and traceable.

Who is a Significant Data Fiduciary under the DPDP Act?

A Significant Data Fiduciary is a data fiduciary who is classified as such on the basis of various factors: the volume and sensitivity of personal data they are processing, the turnover of the organization, and the potential risk posed to the rights of data principals. Because of increased potential consequences associated with the data processing activities of organizations declared as SDFs, additional obligations in terms of compliance apply to them.

What are the obligations of Significant Data Fiduciaries?

Significant Data Fiduciaries are required to meet stricter regulatory standards. These include appointing a Data Protection Officer (DPO), conducting periodic data protection impact assessments (DPIAs), maintaining enhanced reporting mechanisms, and being subject to regular audits by the Data Protection Board. These measures ensure that SDFs, due to their scale and impact, handle personal data with extra care and compliance rigor.

What role does a Data Protection Officer (DPO) play in Significant Data Fiduciaries?

A Data Protection Officer (DPO) is responsible for overseeing compliance with data protection laws within a Significant Data Fiduciary. The DPO acts as the liaison between the organization, data principals, and the Data Protection Board, ensuring that all data processing activities comply with the DPDP Act. The DPO also manages data subject rights requests, conducts impact assessments, and ensures proper data governance practices are followed.

What is the role of a Data Processor?

A Data Processor is an entity that processes personal data on behalf of a Data Fiduciary. While Data Fiduciaries determine the purposes and means of processing, Data Processors handle the operational aspects, such as collecting, storing, or analyzing data. Under the DPDP Act, Data Processors are required to comply with the regulations even if they do not directly face penalties. They must ensure they meet contractual obligations with the Data Fiduciary and adhere to data security standards.

How do Data Fiduciaries manage third-party compliance?

Data Fiduciaries must ensure that any third-party Data Processors they engage with are compliant with the DPDP Act. This is typically managed through legal contracts and regular compliance audits. Fiduciaries often use tools like Privy’s Third-Party Compliance Management to monitor and assess the risks posed by Data Processors, ensuring that they follow the same data protection principles and standards required by the law.

Are Data Processors held liable under the DPDP Act?

While the primary liability for data breaches and non-compliance rests with Data Fiduciaries, Data Processors can also be held accountable if they fail to adhere to contractual obligations or act outside the instructions of the Data Fiduciary. Therefore, even though fines are typically directed at Fiduciaries, Processors are also responsible for maintaining compliance to avoid legal and operational risks.